Common Telehealth Billing Mistakes (2026): Your Complete Guide to Getting Paid Right

A Stepwise Guide by LifeCareBilling

Telehealth has transformed healthcare delivery. Your patients love the convenience, your schedule stays full, and care quality remains high.

But here’s the frustrating part: even when your virtual care is excellent, your revenue can quietly fall apart because of small billing mistakes.

One incorrect code. One missing modifier. One documentation detail left out. That’s all it takes for a clean telehealth visit to turn into a claim denial, a payment delay, and another avoidable A/R follow-up cycle.

If you’re seeing telehealth claim denials or slow payments, you’re not alone. The good news is that most telehealth billing errors follow predictable patterns—meaning they’re fixable when you tighten the workflow.

This guide breaks down the most common telehealth billing mistakes, why they happen, and how to fix them. But most importantly, it shows how LifeCareBilling helps you prevent these errors at the system level—so you get paid correctly, faster, and with less stress.

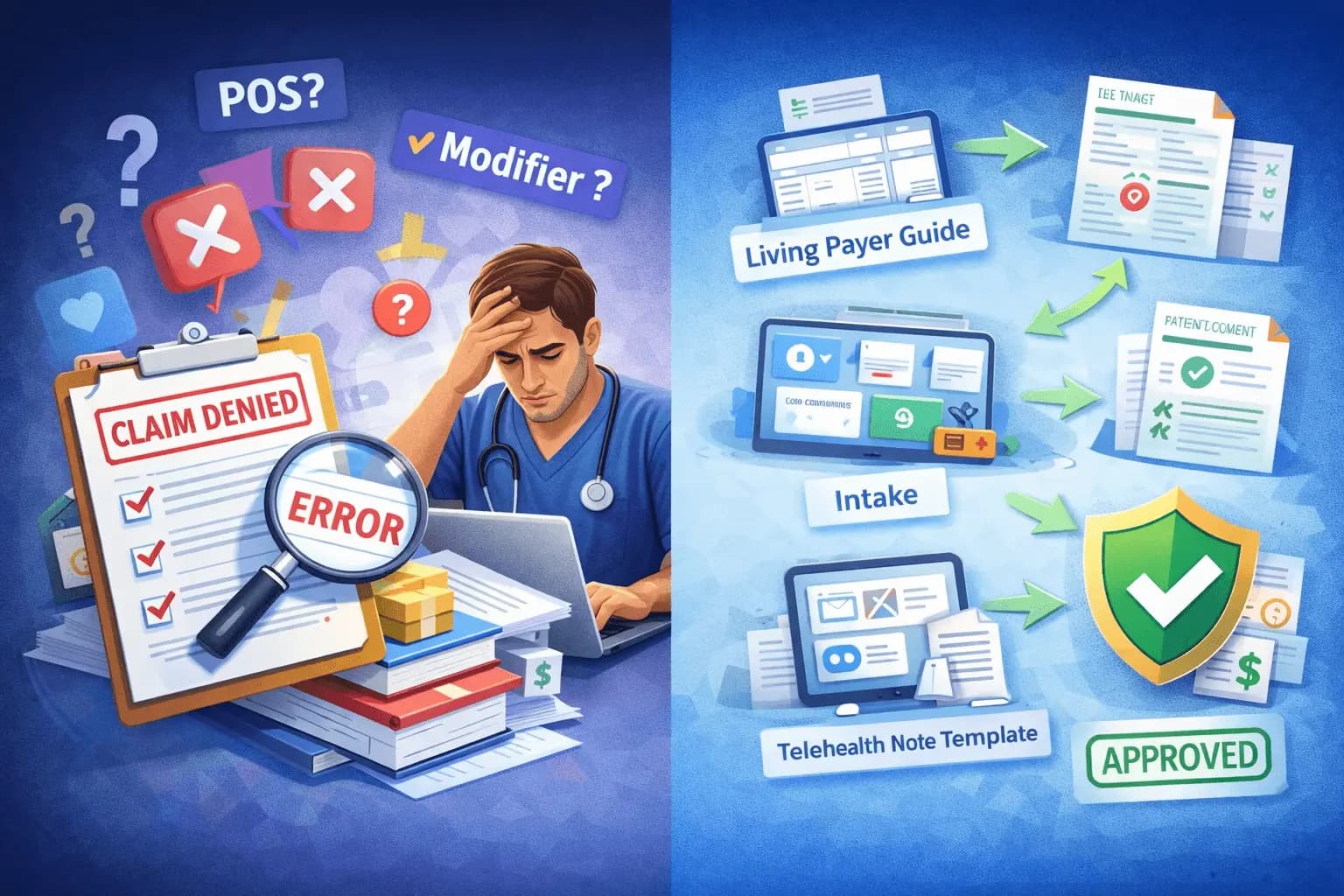

Why smart practices still make telehealth billing mistakes (and why LifeCareBilling starts with workflow)

Telehealth billing mistakes rarely happen because someone “isn’t paying attention.” They happen because telehealth billing is genuinely complex—and it gets harder as you grow.

Most practices start with basic video visits. Then they add new insurance plans, new provider schedules, and sometimes new states. They introduce audio-only for access. The team expands. The EHR changes. Patient volume increases.

Each change adds another moving part.

And here’s what makes telehealth different than in-person care: virtual visits introduce variables that directly affect reimbursement—patient location, technology used, payer rules, modifiers, POS codes, documentation requirements, and authorization rules.

When those details aren’t captured correctly from the start, claims become vulnerable—even when the care was flawless.

That’s why LifeCareBilling takes a workflow-first approach. We don’t just “submit claims.” We help telehealth practices build a repeatable operating system for billing—so the right details are captured every time and errors stop repeating.

The Most Common Telehealth Billing Mistakes (And How to Fix Them) — with the LifeCareBilling “no-chaos” approach

Telehealth billing usually doesn’t break on day one. It breaks after you’ve scaled—more providers, more payers, more states, more visit types, more tools. That’s when small inconsistencies turn into denials, delays, and growing A/R.

The goal isn’t to memorize rules. The goal is to build a system that prevents errors by default. That’s exactly how LifeCareBilling supports telehealth teams—by tightening the workflow so claims go out clean, documentation supports the code, and denial patterns stop repeating.

Mistake #1: Assuming all insurance plans follow the same telehealth rules

This is the “it worked once, so it should work everywhere” trap. One payer pays with a certain POS/modifier combo—then a second payer denies the same setup and it feels random.

Why it hurts: payer policies differ on POS, modifiers, and especially audio-only rules. If your team is guessing, your claims become inconsistent.

Fix: keep a simple, living payer guide (even a spreadsheet) that answers: POS, modifiers, audio-only approach, and any note requirements.

How LifeCareBilling helps: we standardize payer-specific claim rules into an easy workflow so your staff isn’t relying on memory—and your denials don’t depend on who’s on shift.

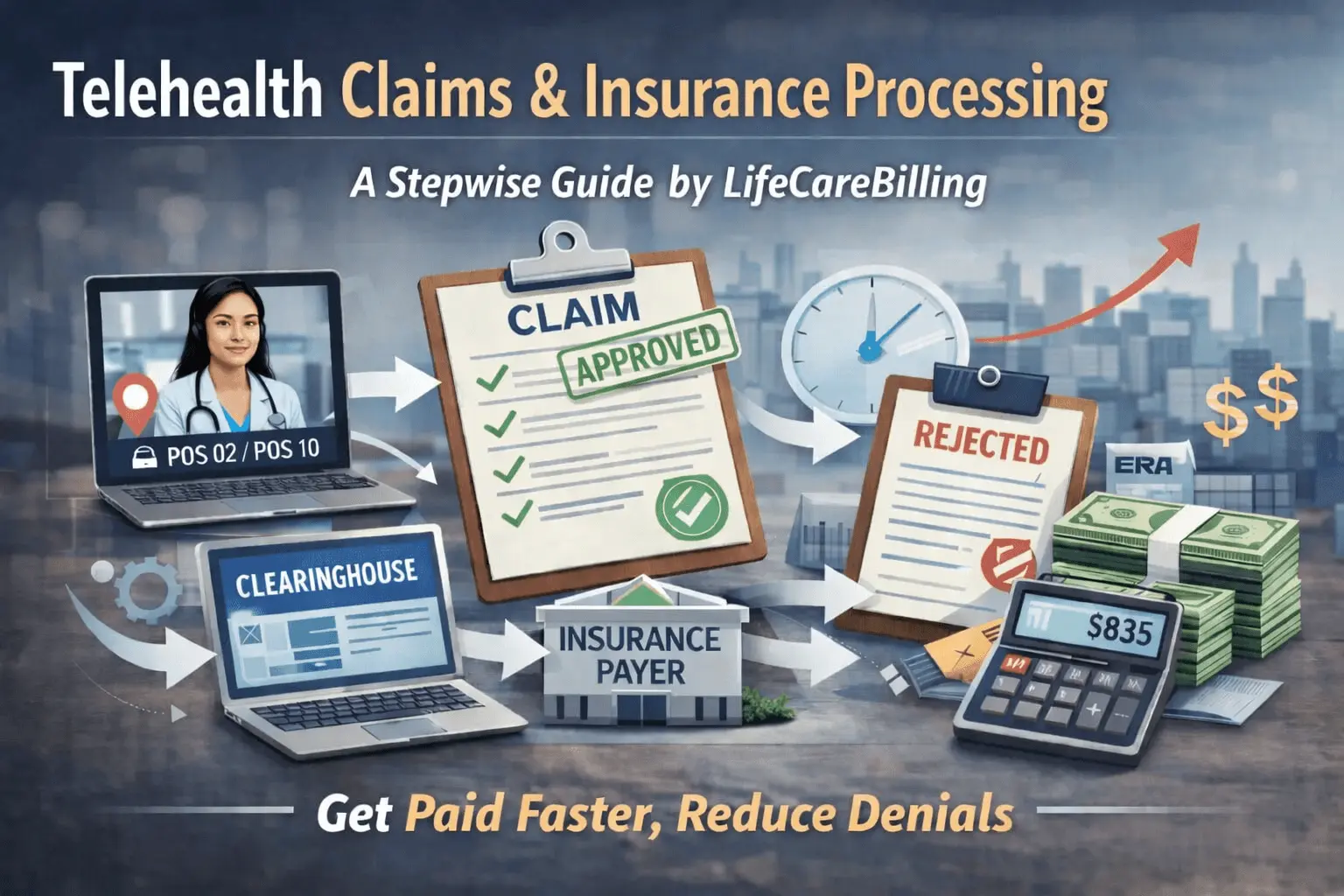

Mistake #2: POS errors (POS 02 vs POS 10) that trigger denials or underpayments

POS looks like a small code, but it can change how the payer processes the claim. Many practices choose one POS and use it everywhere.

Why it hurts: wrong POS can cause auto-denials, lower reimbursement, or routing problems—especially when patient-at-home rules apply.

Fix: capture patient location and visit type at intake, not later during billing. POS should be decided from real visit facts, not “best guess.”

How LifeCareBilling helps: we build intake-to-billing handoffs that consistently capture what billing needs (location + modality), so POS stops being a recurring denial reason.

Mistake #3: Modifier confusion (especially modifier 95)

Modifier mistakes are one of the fastest ways to get a claim rejected before a human reviews it. It’s common to see modifier 95 missing, used incorrectly, or paired with the wrong POS/code.

Why it hurts: payers use modifiers to apply coverage logic. If the modifier is wrong, the claim often fails an automated edit.

Fix: create a simple decision rule your team follows every time: video vs audio-only, payer requirement, correct modifier, and correct POS pairing.

How LifeCareBilling helps: we set up “clean claim” routines and catch modifier/POS pattern issues early—before they become a monthly denial trend.

Mistake #4: Incomplete documentation (the silent claim killer)

If you want a real drop in telehealth denials, this is where it happens. Documentation doesn’t need to be long—it needs to be consistent.

Most commonly missing:

- visit modality (audio-video vs audio-only)

- patient location (home/other + state when relevant)

- consent (when payer/state expects it)

- time or MDM support for E/M level

Fix: use a telehealth note template that prompts these details automatically. When it’s built into the note, it stops being forgotten.

How LifeCareBilling helps: we align documentation habits with billing requirements so your CPT level is supported and your claims are easier to defend.

Mistake #5: Skipping telehealth-specific eligibility verification

Coverage isn’t just “active or inactive.” Telehealth benefits can vary by plan, and audio-only can be restricted.

Why it hurts: you find out after the visit that the plan covers telehealth differently, the patient responsibility is higher, or the visit type isn’t payable the way you expected.

Fix: verify eligibility with telehealth in mind—coverage, restrictions, patient responsibility, and auth/referral rules when applicable.

How LifeCareBilling helps: we connect verification and billing readiness so you don’t deliver care first and discover payment problems later.

Mistake #6: Ignoring prior auth/referral rules because it’s “telehealth”

Telehealth doesn’t automatically bypass utilization rules. If a service needs authorization in-person, it often needs it virtually too.

Fix: run the same authorization logic you use for in-person visits and flag auth-required visit types at scheduling.

How LifeCareBilling helps: we help you spot where auth gaps are creating predictable denials—and tighten scheduling workflows so it stops happening.

Mistake #7: Billing audio-only incorrectly (high-risk + high-variance)

Audio-only rules vary widely, and many practices accidentally bill audio-only like video.

Why it hurts: wrong codes/modifiers for audio-only can trigger denials, audits, and recoupments—especially as policies change.

Fix: separate audio-only from audio-video from the start. Confirm coverage before the visit, use the correct code family, and document why audio-only occurred.

How LifeCareBilling helps: we build clear modality capture and billing rules so audio-only claims don’t become your biggest compliance + denial exposure.

Mistake #8: Wrong E/M level because the note doesn’t support it

Telehealth notes often become shorter. That’s fine—until the documentation doesn’t support the billed level (time or MDM).

Fix: make time documentation consistent when billing by time, and make MDM elements clear when billing by complexity. Review denial rates by provider to spot patterns fast.

How LifeCareBilling helps: we identify which providers/visit types are generating denials and fix the documentation pattern—not just the individual claim.

Mistake #9: Scaling multi-state telehealth without billing infrastructure

Multi-state growth multiplies complexity: enrollment, payer rules, rendering/billing provider accuracy, and workflow consistency.

Fix: build one strong operating system and replicate it—don’t create a new process for each state/provider.

How LifeCareBilling helps: we keep growth from breaking revenue—supporting clean enrollment workflows, consistent claim rules, and reporting visibility so issues don’t hide until they’re expensive.

Mistake #10: Not tracking denial patterns (so mistakes repeat forever)

Fixing claims one-by-one feels productive, but if you don’t track denial categories, the same errors keep coming back.

Fix: track denials by category (POS, modifier, eligibility, documentation, auth, CPT mismatch) and review them regularly. When a reason repeats, fix the workflow—not just the claim.

How LifeCareBilling helps: we turn denials into action—finding the root cause, adjusting the workflow, and preventing repeat errors so your telehealth revenue becomes predictable.

The LifeCareBilling difference: we don’t just “work claims”—we remove the weak points

Telehealth billing becomes stable when your workflow is stable. LifeCareBilling helps you reduce errors by building structure across the parts that usually create denials: intake → documentation → coding rules → clean claim submission → denial prevention → A/R follow-up.

If you want, I can also rewrite your ending CTA in a stronger, more “human” tone (with New York + nationwide targeting) and add a short copy/paste telehealth billing checklist that matches this blog.

Your Quick Telehealth Billing Checklist

Before submitting claims, verify:

- ✓ Visit modality documented (audio-video vs. audio-only)

- ✓ Correct POS code selected based on patient location and payer requirements

- ✓ Appropriate telehealth modifier applied

- ✓ Documentation supports the billed E/M level

- ✓ Insurance verified with telehealth benefits confirmed

- ✓ Prior authorization obtained if required

- ✓ Claims reviewed for common denial triggers

How LifeCareBilling Helps Telehealth Practices Thrive

At LifeCareBilling, we understand something important: telehealth revenue only stays strong when your workflows are structured correctly.

We help telehealth practices across New York (including Long Island) and nationwide by:

- Building clean claim submission processes that prevent denials

- Creating payer-specific telehealth billing protocols

- Aligning documentation practices with coding requirements

- Implementing denial prevention systems and disciplined A/R follow-up

- Providing visibility through reporting so problems surface early

We don't just fix billing problems—we prevent them by building better systems.

Want to discover what's causing your telehealth denials? Call (631) 966-1755 or request a Free Billing Analysis to identify what's leaking revenue and what to fix first.

Frequently Asked Questions

What are the most common telehealth billing mistakes?▼

The biggest mistakes include using incorrect Place of Service codes (POS 02 vs. POS 10), modifier errors (especially with modifier 95), documentation gaps (missing modality, location, or time details), insurance eligibility failures, and incorrectly billing audio-only visits as video visits.

Why do telehealth claims get denied?▼

Most telehealth denials result from workflow mismatches—wrong POS or modifier combinations, incomplete documentation, insurance eligibility issues, missing prior authorizations, or payer-specific rules that weren't followed consistently.

How can I reduce telehealth claim denials?▼

Standardize your telehealth workflow from start to finish. Capture visit modality and patient location during scheduling. Use payer-specific POS and modifier rules. Build documentation templates that include all required elements. Verify insurance eligibility early. Track denial patterns weekly to identify and fix recurring issues.

How does LifeCareBilling help telehealth practices?▼

We build billing-ready infrastructure that prevents denials and protects revenue. This includes clean claim submission systems, denial prevention protocols, A/R follow-up discipline, documentation alignment, and clear reporting—so your telehealth revenue stays predictable as you grow.

Back to Blog

Back to Blog January 6, 2026

January 6, 2026