A Practical RCM Guide — by LifeCareBilling

Telehealth clinics move fast. Your providers can complete a full day of visits without a waiting room, without room turnover, and without the friction that slows traditional care.

But revenue doesn’t automatically move fast just because care does.

In fact, telehealth revenue management is where many clinics feel the biggest pressure. You can be fully booked, growing month over month, and still deal with delayed deposits, rising denials, unpredictable A/R, and patient balances that don’t get collected cleanly. The clinic looks successful from the outside—while cash flow feels unstable behind the scenes.

This is exactly what revenue management is supposed to fix.

Revenue management for telehealth clinics isn’t just “billing.” It’s the full operating system that turns a completed visit into collected revenue. It covers the steps before the visit, the billing rules during the visit, and the follow-up after the visit. When it’s built properly, payments become predictable. When it’s weak, revenue becomes reactive—and growth becomes stressful.

LifeCareBilling helps telehealth clinics in New York (including Long Island) and nationwide build a revenue cycle that fits virtual care. We focus on clean claim systems, payer-aware workflows, denial prevention, A/R discipline, and reporting visibility—so telehealth clinics get paid faster and scale without revenue chaos.

Why telehealth revenue management is different (and why small gaps become expensive)

Telehealth introduces variables that impact reimbursement more than many clinics expect. Patient location matters. Modality matters. POS selection matters. Payer rules vary more. Documentation needs to be consistent. Audio-only policies shift. Multi-state delivery adds complexity. Even small mismatches can trigger edits, manual reviews, or denials.

At low volume, you can survive on “fixing things as they come up.”

At scale, that approach breaks.

Telehealth clinics don’t usually lose revenue because one claim denies. They lose revenue because the same issues repeat across dozens or hundreds of claims—creating a constant backlog of rework, resubmissions, and follow-ups. That’s how Days in A/R climbs quietly, and that’s how a busy clinic can still feel cash-flow pressure.

Revenue management fixes this by building a system that makes clean claims the default and makes denial patterns visible early—before they become expensive.

The telehealth revenue cycle: where money is won or lost

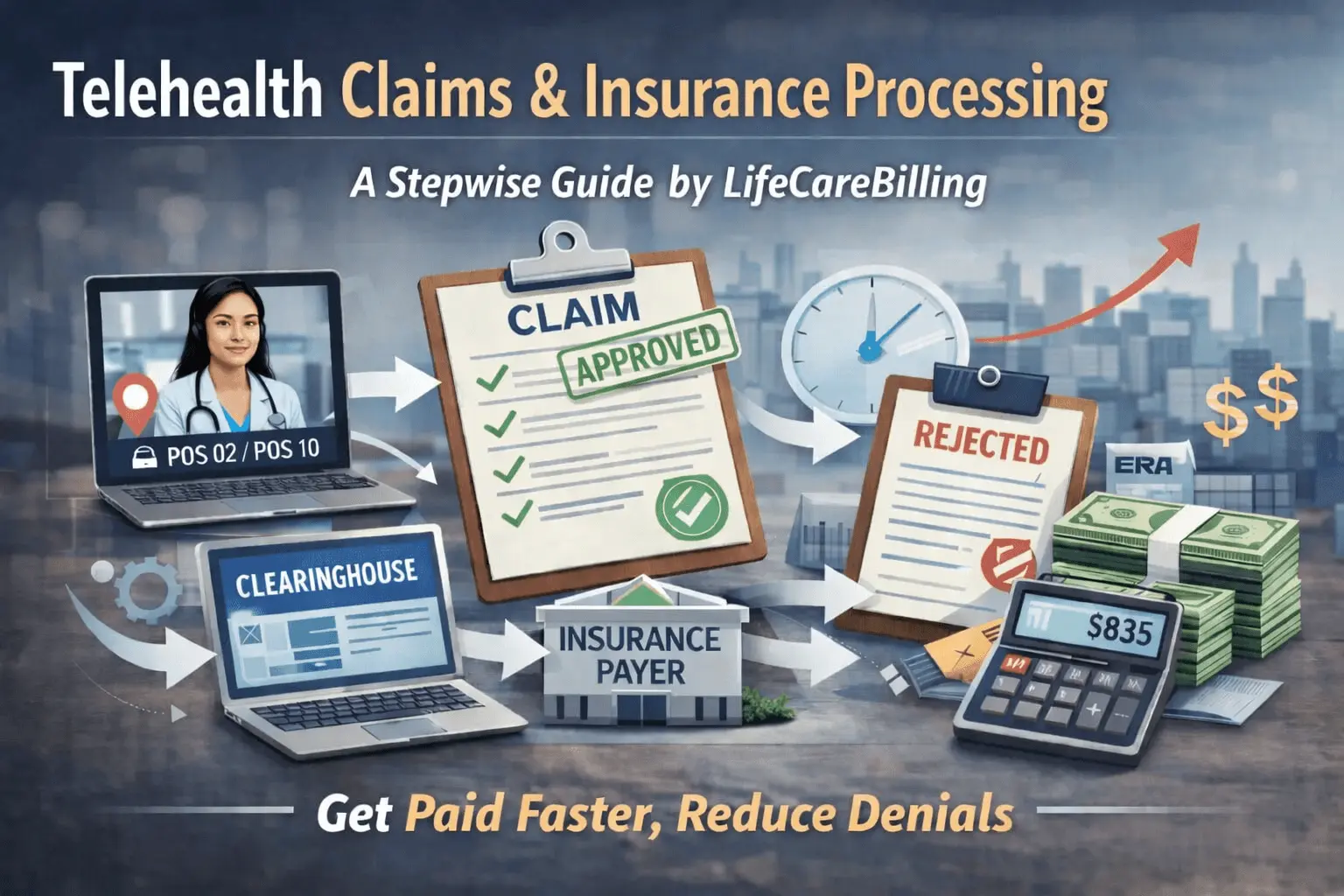

A telehealth clinic gets paid faster when the entire flow is connected:

Scheduling and registration capture correct demographics and insurance details. Eligibility and benefits are verified in a telehealth-aware way. Patient responsibility is known and communicated clearly. Documentation supports coding and payer expectations. Claims are submitted cleanly with correct POS and modifier logic. Payments are posted correctly, and underpayments are caught. Denials are worked quickly, and root causes are fixed so they don’t repeat. A/R is managed with discipline so money doesn’t sit in queues.

Most clinics don’t fail every step. They usually fail one or two—and that’s enough to slow down everything.

LifeCareBilling focuses on the steps that create the biggest delays and builds structure where clinics usually rely on memory or improvisation.

Step 1: Front-end accuracy is the fastest way to improve cash flow

Revenue management starts before the visit happens. That’s where fast-paying telehealth clinics separate from slow-paying ones.

If registration is incomplete, eligibility is assumed, or the payer requirements aren’t identified early, the claim is born “at risk.” And once the visit is done, fixing those issues takes far longer than preventing them.

LifeCareBilling helps clinics tighten front-end workflows so the right information is captured early. That reduces claim bounce-backs, prevents avoidable denials, and improves first-pass acceptance—the single biggest driver of faster telehealth reimbursement.

Step 2: Eligibility verification that actually matches telehealth reality

Eligibility checks for telehealth need to do more than confirm “active coverage.” A plan can be active and still have telehealth-specific restrictions that affect payment.

Telehealth revenue management improves when clinics verify benefits in a way that prevents surprises later. That includes confirming telehealth coverage expectations, patient responsibility, and any limitations that could cause denial after the visit.

LifeCareBilling helps build this into the workflow so your clinic isn’t discovering coverage problems weeks later through denials.

Step 3: Clean claims and first-pass acceptance — the core metric that matters

If you want to understand revenue management in one sentence: clinics get paid faster when claims are accepted and paid without rework.

That’s first-pass acceptance.

Every time a claim denies, goes to manual review, or requires additional information, you add time. Not just on that claim, but on your entire billing operation, because now your team is doing rework while new claims continue to come in.

LifeCareBilling focuses intensely on clean claim submission because it’s the fastest way to reduce Days in A/R. We help clinics improve the fundamentals that drive clean claims: correct patient and provider data, correct coding logic, consistent documentation, and payer-aware rules.

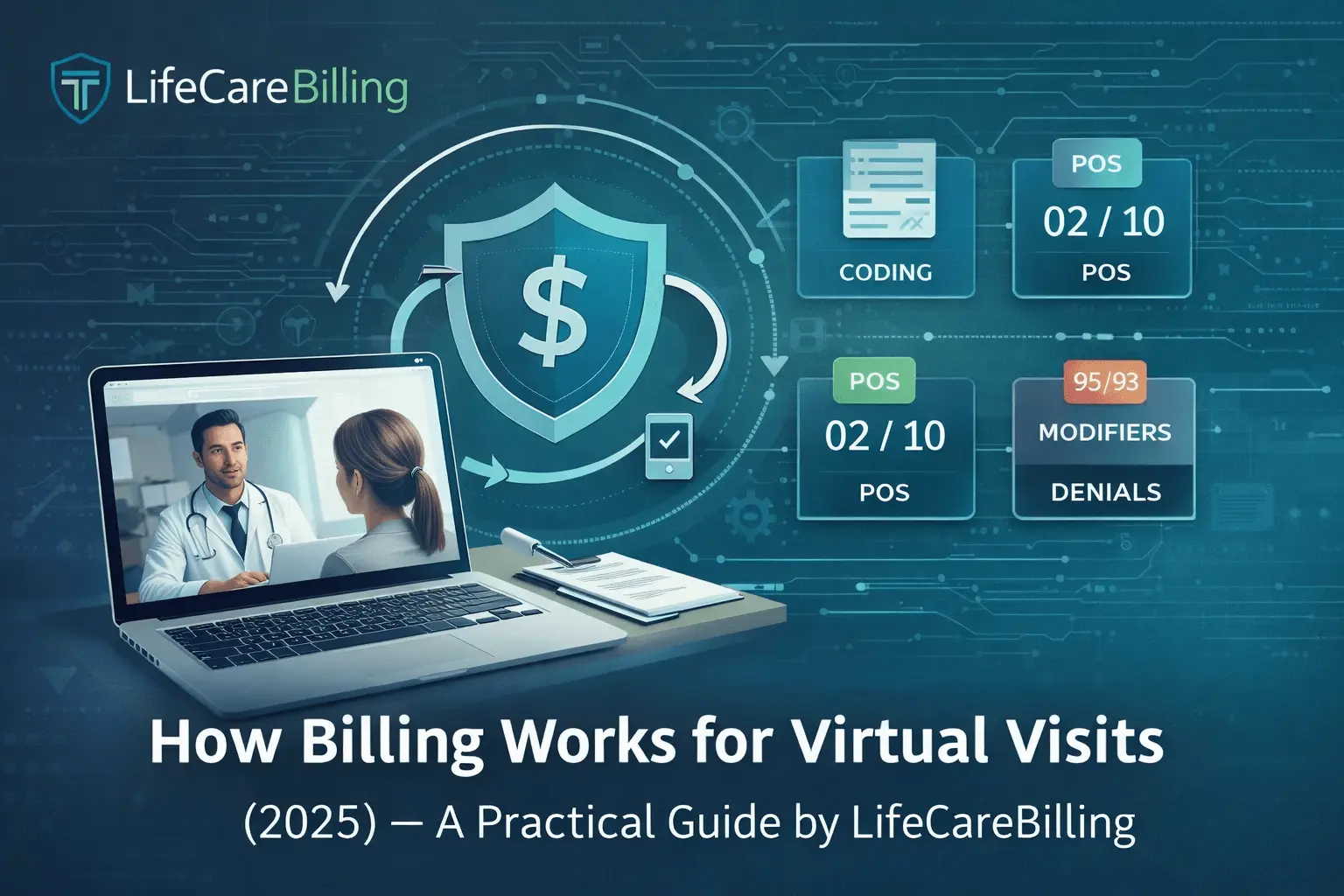

Step 4: POS and modifiers — the telehealth details that make or break payment speed

Telehealth claims get delayed often because POS and modifiers are applied inconsistently.

Many clinics use one approach across every payer because it worked once. Then they get denials that feel random.

Revenue management improves when telehealth billing logic becomes consistent and payer-aware, not guess-based.

LifeCareBilling helps clinics prevent these errors by building a workflow where patient location and modality are captured clearly and coding rules are applied consistently. When POS and modifier logic is stable, payer edits stop blocking payment.

Step 5: Documentation alignment — the invisible reason claims get stuck

Telehealth documentation doesn’t need to be long. It needs to be consistent and supportive of what you billed.

The biggest revenue leaks we see are not “bad care” problems. They’re documentation mismatches: modality not stated clearly, patient location missing, consent expectations not recorded when needed, time or MDM support unclear, or visit notes that vary too much between providers.

Revenue management gets stronger when documentation becomes structured enough to support billing automatically, without adding burden to clinicians.

LifeCareBilling helps clinics align documentation and billing so claims are defensible, payer requests for records decrease, and denials become less frequent.

Step 6: Denial prevention is the real profit move (not denial fixing)

Most clinics spend too much time fixing denials and not enough time preventing them.

A denial is rarely “random.” Denials usually repeat: POS mismatch denials repeat, modifier denials repeat, eligibility denials repeat, authorization denials repeat, documentation denials repeat.

Telehealth revenue management becomes powerful when you treat denials like feedback, not bad luck. When the same denial reason appears repeatedly, the workflow must change.

LifeCareBilling tracks denial patterns and fixes the root cause. That’s how denial work turns into denial prevention—and that’s how revenue becomes predictable.

Step 7: A/R follow-up discipline is what keeps cash flow stable

A/R is where revenue either arrives on time or gets stuck.

Telehealth clinics with strong revenue management don’t “wait and hope.” They track what’s pending, what’s aging, what’s denied, and what needs action now. They don’t let claims sit until they’re too old to fix easily.

LifeCareBilling supports this with disciplined follow-up so claims don’t age out, timely filing risk is reduced, and cash flow stays steady.

Step 8: Patient payments are part of revenue management (especially in telehealth)

Telehealth clinics often have strong insurance billing but weak patient payment workflows. Without a front desk checkout moment, copays and deductibles can quietly go uncollected until balances grow.

Revenue management for telehealth has to include patient responsibility: verifying it, communicating it, and collecting it efficiently.

LifeCareBilling helps clinics optimize patient payment workflows so patient balances don’t become the slowest part of your revenue cycle.

Step 9: Reporting visibility — how telehealth clinic owners stop guessing

Founders and clinic owners usually know they’re busy. They know visits are happening. But they don’t always know: what’s pending, what’s denied, what’s underpaid, which payer is slowing down, and which issue is creating the most revenue drag.

Revenue management improves when the clinic has visibility into the right metrics: Days in A/R, first-pass acceptance, denial categories, payer turnaround time, net collections, and patient collection performance.

LifeCareBilling provides the reporting clarity that helps clinics make revenue decisions confidently—because you can’t improve what you can’t clearly see.

How LifeCareBilling supports revenue management for telehealth clinics

LifeCareBilling helps telehealth clinics build a revenue cycle that stays fast as you scale. We strengthen the full workflow: from intake and verification to clean claim submission, denial prevention, A/R discipline, and reporting visibility.

We support clinics in New York (including Long Island) and nationwide. And our focus is always the same: predictable reimbursement, fewer denials, lower Days in A/R, and a workflow your team can actually follow when volume increases.

If you want telehealth revenue that arrives on time—without constant rework—start with a clear review of where your money is getting stuck.

Call (631) 966-1755 or click Get Free Billing Analysis to see how LifeCareBilling can help you build a stronger telehealth revenue system for 2026 and beyond.

Frequently Asked Questions

What is revenue management for a telehealth clinic?▼

Revenue management for a telehealth clinic is the full system that turns completed virtual visits into collected revenue. It includes front-end intake, eligibility and benefits verification, POS and modifier accuracy, documentation alignment, clean claim submission, payment posting, denial prevention, A/R follow-up, and patient payment workflows.

How is telehealth revenue management different from regular medical billing?▼

Telehealth adds billing-sensitive variables that increase denial risk if they’re not captured consistently—patient location, visit modality (audio-video vs audio-only), POS selection (often involving POS 02 vs POS 10), payer-specific modifier rules, and multi-state considerations. Small workflow gaps in telehealth create bigger payment delays.

Why are telehealth payments delayed even when visits are done correctly?▼

Because insurance processing depends on claim accuracy and consistency. If eligibility wasn’t verified, POS or modifiers were applied incorrectly, documentation doesn’t clearly support the billed service, or authorization was missed, the claim can be delayed, pushed to manual review, or denied—adding weeks to reimbursement.

What is “first-pass claim acceptance” and why does it matter?▼

First-pass claim acceptance means a claim is accepted and paid without rework. It’s one of the strongest drivers of faster reimbursement because every denial or correction cycle adds time, staff workload, and Days in A/R. Strong revenue management increases first-pass acceptance by preventing errors before submission.

What are the most common revenue leaks for telehealth clinics?▼

The most common leaks include incomplete registration data, missed eligibility checks, POS/modifier mismatches, documentation gaps (modality/location/time/MDM), missed prior authorization, inconsistent provider note patterns, slow denial follow-up, underpayments that aren’t tracked, and patient responsibility that isn’t collected upfront.

Back to Blog

Back to Blog January 7, 2026

January 7, 2026