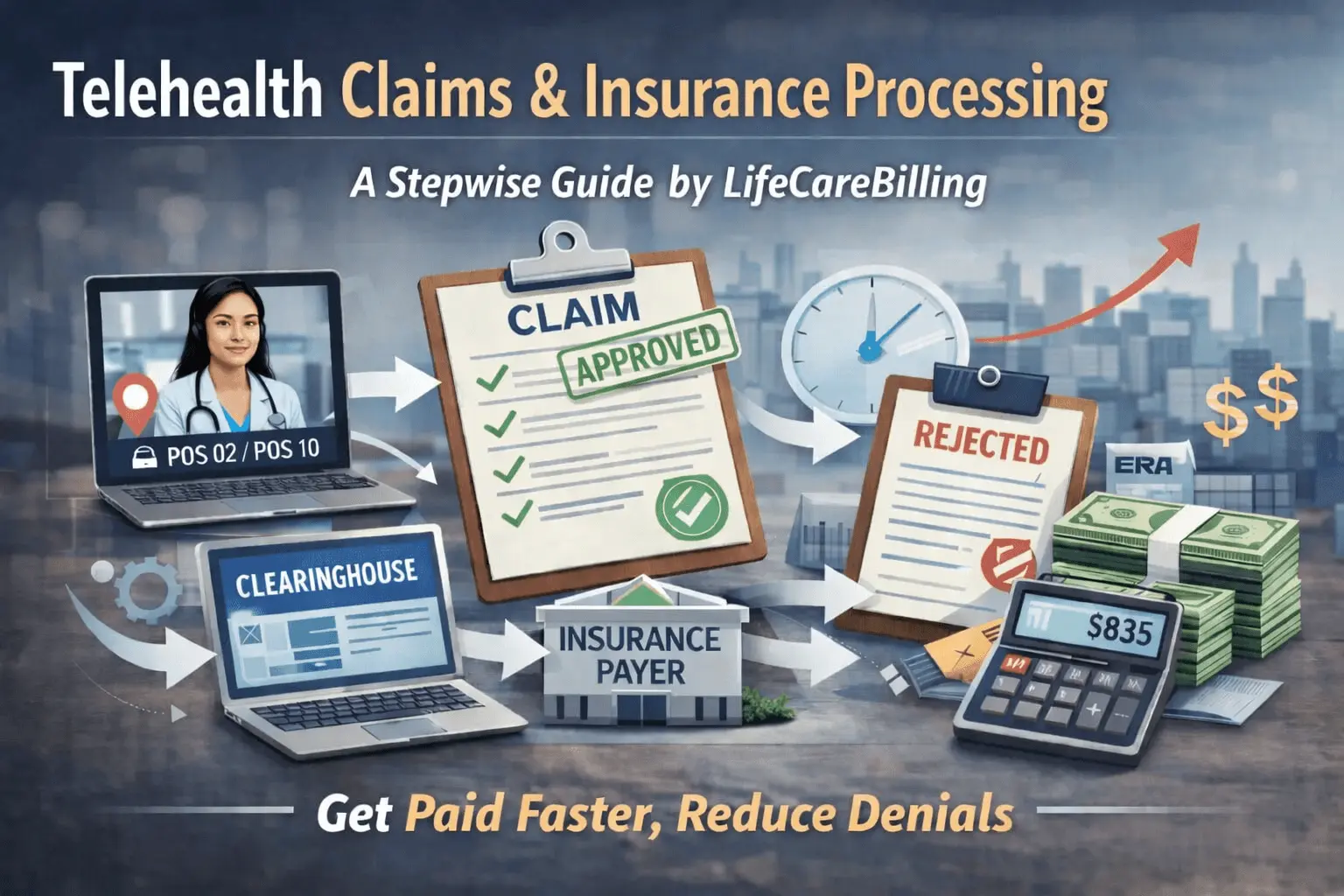

Telehealth Claims & Insurance Processing (2026)

A Stepwise Guide — by LifeCareBilling

If you run a telehealth practice, you already know the clinical side can move fast. A patient books. Your provider meets them virtually. The visit is done.

But the money doesn’t move like that.

Telehealth payments often feel delayed, inconsistent, and confusing—not because you delivered care incorrectly, but because insurance processing is a multi-step system. When one small detail is missing or mismatched, the claim doesn’t “slow down a little.” It often stops completely. Then the only way forward is rework, resubmission, or appeal—and that’s where Days in A/R quietly grows.

This guide explains telehealth claims and insurance processing in a clear, real-world way. Not legal language. Not theory. Just what actually happens from the moment a telehealth visit is scheduled to the moment payment lands—and how to stop claims from getting stuck in the middle.

And throughout this guide, one theme stays consistent: LifeCareBilling helps telehealth teams get paid faster by fixing the workflow behind the claim. We don’t just push claims out. We build the system that makes payers accept them cleanly, process them faster, and deny them less.

(Informational guidance, not legal advice. Always confirm requirements with your compliance/legal team.)

Why telehealth claims get stuck more often than in-person claims

Telehealth introduces extra variables that insurers care about. With in-person visits, location is obvious. With telehealth, location becomes a billing rule. Modality becomes a billing rule. Documentation language becomes a billing rule. And payer preferences can vary more than clinics expect.

Most telehealth payment delays come from a predictable set of breakdowns:

The claim was submitted with a POS that the payer doesn’t accept for that scenario. The telehealth modifier logic didn’t match the payer’s edits. The note didn’t clearly show modality or patient location. Eligibility was assumed but not verified. Authorization was needed but missed. Or the claim was never truly “accepted” cleanly in the first place and got rejected upstream.

That last one matters: many clinics assume a “denial” is the first failure point. In reality, telehealth claims can fail before the payer even adjudicates them—during formatting checks, clearinghouse edits, or missing fields required for the standard claim format.

LifeCareBilling helps by making the claim pipeline stable. When intake, documentation, coding, and submission are aligned, claims don’t stop midstream. They move through adjudication the way they’re supposed to.

Step 1: Eligibility and benefits must be confirmed before the visit

The biggest mistake telehealth practices make is treating eligibility as a simple checkbox. Active insurance doesn’t automatically mean telehealth coverage works the way you expect, especially for audio-only, multi-state care, or specific specialties.

In modern billing workflows, eligibility and benefits are commonly handled through standard electronic transactions (often referenced as 270/271 in EDI workflows). (CGS Medicare)The practical takeaway is not the transaction number—it’s the result: you want payer clarity before you deliver care, because finding out after the claim denies is always slower and harder.

LifeCareBilling helps practices tighten the front end so payer restrictions, patient responsibility, and authorization needs don’t become “surprises” weeks later when the claim bounces back.

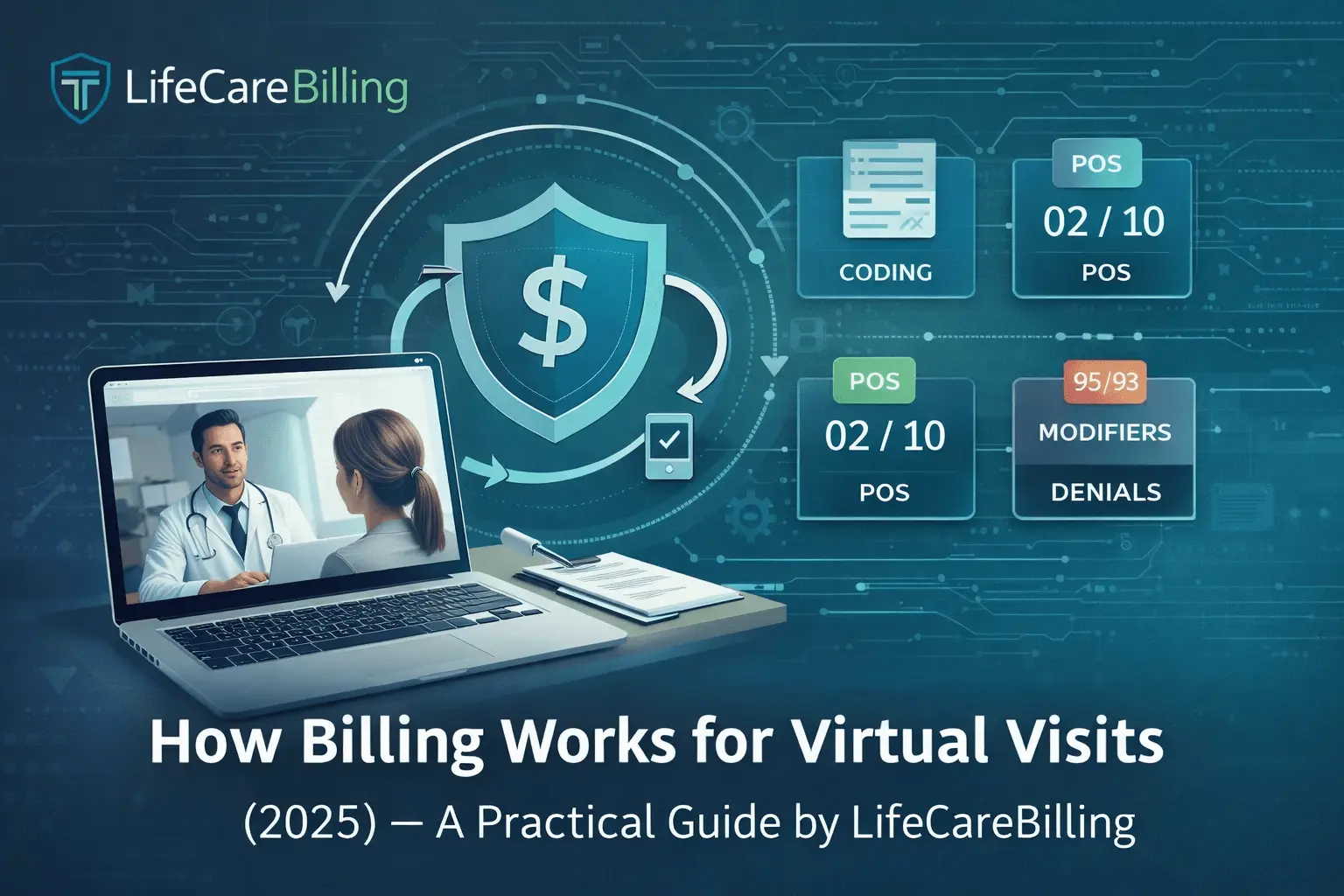

Step 2: Telehealth POS selection is not optional—it's a payment trigger

For telehealth, POS isn’t just “administrative.” It affects reimbursement logic and payer processing.

HHS telehealth billing guidance clearly distinguishes POS 02 as telehealth provided other than in the patient’s home and POS 10 as telehealth provided in the patient’s home.CMS also formalized the updated POS descriptions and the addition of POS 10, including official descriptors that payers and systems rely on.

This is exactly why telehealth claims reject or delay: the visit happened correctly, but the claim was built with the wrong “setting” signal.

LifeCareBilling supports telehealth teams by building POS logic into workflow. We want the correct patient-location detail captured early—so POS isn’t guessed later under billing pressure.

Step 3: Your claim is built in a standard electronic format (and errors happen here)

Many clinics don’t realize how structured claim submission really is. A professional claim is typically transmitted electronically using the standard format described by CMS as the 837P (professional electronic claim format).

If your claim data is missing key elements, mismatched, or formatted incorrectly, the claim can fail before the payer even evaluates medical necessity or coverage.

This is why LifeCareBilling is so strict about clean claim structure. When claims are built consistently, the payer’s system can adjudicate them automatically instead of forcing manual intervention.

Step 4: Clearinghouse edits can reject the claim before the payer even sees it

Think of the clearinghouse step as a quality-control gate in the middle of the pipeline.

NextGen explains that the 837 file generated during submission gets uploaded and the clearinghouse performs edits before forwarding claims to payers.CareCloud similarly describes a clearinghouse as the bridge that facilitates exchange between providers and payers

Clinics often call these failures “denials,” but many are actually rejections—meaning the claim didn’t pass basic acceptance rules. That distinction matters because the fix is different, and the delay can be avoided by catching issues before submission.

LifeCareBilling focuses heavily on this stage because preventing rejections is one of the fastest ways to reduce Days in A/R. If the claim is accepted cleanly the first time, everything downstream accelerates.

Step 5: The payer adjudicates the claim, then sends remittance details back

Once a claim is accepted and processed, payers communicate payment decisions through remittance advice. CMS notes that Medicare contractors use remittance advice to communicate decisions like payments, adjustments, and denials, and references the 835 standard transaction for Electronic Remittance Advice (ERA).

This is where underpayments, bundling edits, or denial reasons show up. Clinics often don’t track this information systematically, so issues repeat for months.

LifeCareBilling supports telehealth practices by treating remittance as intelligence—not paperwork. We track what payers are doing, identify patterns, and tighten workflows so the same issues don’t keep resurfacing.

Step 6: Claim status checks and follow-up are where fast clinics separate from slow clinics

After claims are submitted, the clinics that get paid faster don’t wait passively. They run systematic claim status follow-up.

In EDI workflows, claim status inquiry/response is commonly handled via 276/277. A Medicare contractor guide lists these standard HIPAA transactions in the broader set used for billing operations.UnitedHealthcare also explains that the 276 is used to inquire about claim status and the 277 is used as the response after a claim has been sent.

The key operational insight is simple: if you don’t track what’s pending, you don’t control cash flow. The older a claim gets, the harder it becomes to fix, and timely filing deadlines become a real risk.

LifeCareBilling runs disciplined follow-up so telehealth revenue doesn’t sit in silent queues. We don’t let claims “age out” while your clinic stays busy delivering more care.

The LifeCareBilling difference: we connect clinical workflow to claim acceptance

Most billing teams focus on the claim after the visit. That’s already late.

LifeCareBilling supports telehealth practices by strengthening the system before the claim exists. We focus on the parts that actually control processing speed:

We tighten eligibility and benefit verification so coverage issues are caught early. We help standardize documentation language so notes match telehealth requirements consistently. We ensure POS logic is tied to patient location and payer behavior, not staff guessing. We improve submission quality so clearinghouse edits don’t bounce claims back. And we run denial prevention and A/R follow-up with discipline so your Days in A/R comes down and your cash flow becomes predictable.

This is how telehealth becomes scalable. Not by working harder on individual claims, but by building a workflow where claims are clean by default.

Why this matters in 2026: telehealth growth makes small processing issues expensive

At low volume, a few delayed claims don’t feel like a crisis.

At scale, those same issues become a financial drag. You see it in rising A/R. In unpredictable deposits. In denials that repeat. In staff burning hours on rework. In underpayments that no one catches. In patient balances that sit too long and turn into bad debt.

LifeCareBilling helps you prevent that future by making claims processing stable now—so your telehealth growth doesn’t turn into revenue chaos later.

How to get started with LifeCareBilling

If your telehealth clinic is busy but reimbursement feels slow, the most productive next step is not guessing. It’s identifying exactly where claims are getting stuck: before submission, at clearinghouse edits, during payer adjudication, or in follow-up.

LifeCareBilling supports telehealth practices in New York (including Long Island) and nationwide. If you want faster payments, fewer denials, cleaner processing, and lower Days in A/R, start with a real review of your claim pipeline.

Call (631) 966-1755 or click Get Free Billing Analysis to see what’s delaying reimbursement and how to fix it with a workflow that stays clean as you scale.

Frequently Asked Questions

What is telehealth claims processing?▼

Telehealth claims processing is the full path your claim follows after a virtual visit—from eligibility confirmation and claim creation to clearinghouse checks, payer adjudication, remittance posting, and (if needed) denial resolution. It’s not one step. It’s a pipeline, and payment speed depends on how cleanly your claim moves through each stage.

Why do telehealth claims get denied more often than in-person claims?▼

Telehealth adds extra variables that payers look for, like patient location, visit modality (audio-video vs audio-only), POS selection (POS 02 vs POS 10), and payer-specific modifier logic. If those details aren’t captured consistently, claims are more likely to hit edits, manual review, or denial—even when care was appropriate.

What’s the difference between a claim rejection and a claim denial?▼

A rejection usually happens before the payer truly adjudicates the claim—often due to formatting issues, missing fields, or clearinghouse edits. A denial happens after the payer reviews the claim and decides it doesn’t meet coverage, coding, documentation, or authorization requirements. Both cause delays, but rejections are often the easiest to prevent with a stronger submission workflow.

How do POS 02 and POS 10 affect telehealth reimbursement?▼

POS codes tell the payer where the telehealth service was delivered. Some payers apply different logic depending on whether the patient is at home or not, which is why POS mistakes can cause denials, delayed processing, or incorrect payment rates. Getting POS right starts by capturing patient location clearly at scheduling and during the visit.

Do I need modifier 95 for telehealth claims?▼

Often, yes—but it depends on payer rules and the type of telehealth visit. Modifier requirements can vary by payer and by modality. That’s why consistent payer-aware rules are so important. The fastest way to create delays is using a “one-size-fits-all” modifier approach across every plan.

What documentation is most important for telehealth insurance processing?▼

The most commonly important elements are visit modality, patient location, consent expectations when applicable, and support for the billed E/M level (time or MDM). The biggest issue isn’t complexity—it’s inconsistency. When documentation varies by provider or visit type, claims become harder to process and easier to deny.

Why does eligibility verification matter for telehealth claims?▼

Because active coverage doesn’t automatically mean telehealth coverage works the way you expect. Some plans limit telehealth by provider type, service type, location, or audio-only rules. If you don’t verify benefits upfront, you often discover restrictions weeks later when the claim denies—adding delays and making patient collection harder.

Back to Blog

Back to Blog January 6, 2026

January 6, 2026