Telehealth Compliance & HIPAA (2026): A Stepwise Guide by LifeCareBilling

Your telehealth visits are running smoothly. Patients are happy. Your schedule is full. On the surface, everything looks perfect.

So why should you worry about compliance?

Because one privacy or security mistake—even a small one you didn’t see coming—can turn into a major headache that slows everything down. And telehealth is the kind of environment where “small” mistakes happen easily: a staff member logs in from an unprotected device, a vendor touches patient data without the right agreement, a visit gets recorded without a clear policy, or a website tracking tool quietly runs on the wrong page.

Here’s what most practices get wrong: they treat telehealth compliance like a checkbox. “We use a secure video platform, so we’re fine.”

But compliance is bigger than the video call.

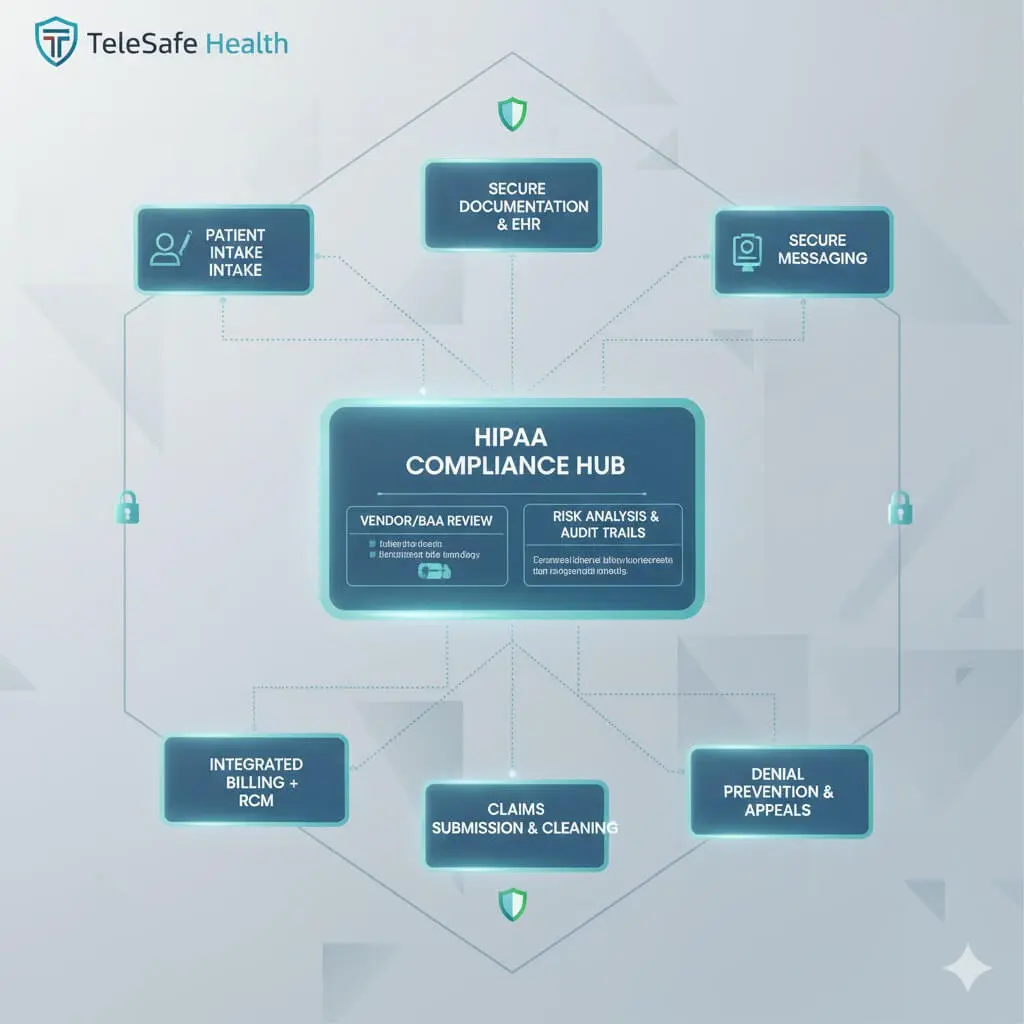

Real HIPAA telehealth compliance touches everything around the visit—your scheduling flow, patient messaging, documentation practices, whether sessions are recorded, vendor contracts, how staff access PHI, device security, and even the tracking tools running on your website or patient portal.

This blog is written like a practical operating manual—not a legal textbook. And it’s built around one goal: helping you run telehealth in a way that stays stable as you scale.

Most importantly, it’s written with a real-world focus on how LifeCareBilling helps you do this without turning you into a compliance office. We’re billing and RCM at the core—but telehealth revenue only stays predictable when your workflows are structured, secure, and defensible.

(Note: This is informational guidance, not legal advice. Always confirm requirements with qualified compliance or legal counsel.)

Why telehealth compliance becomes a problem after you “start winning”

Compliance problems rarely show up on day one. They show up after you’ve done a few hundred virtual visits and your operation starts growing.

You add a second provider, then a third. You add a scheduler. You outsource front desk. You expand to another state. You add a new telehealth platform because it integrates with your calendar. You add texting because patients prefer it. You add a form builder. You add a marketing pixel. Suddenly your workflow becomes a patchwork of tools and processes—and no one person can confidently explain where patient data flows.

This is where risk grows quietly.

And here’s the part many providers don’t realize: when compliance becomes messy, revenue becomes messy too. Telehealth claims get delayed because documentation becomes inconsistent. Denials go up because your process isn’t clean. A/R grows because follow-up gets harder. Even when you’re doing everything right clinically, the back-end becomes unstable.

This is exactly why LifeCareBilling takes a workflow-first approach. We don’t only “work claims.” We help telehealth teams build a repeatable operating system—so your compliance posture and your payments improve together.

What HIPAA really applies to in telehealth

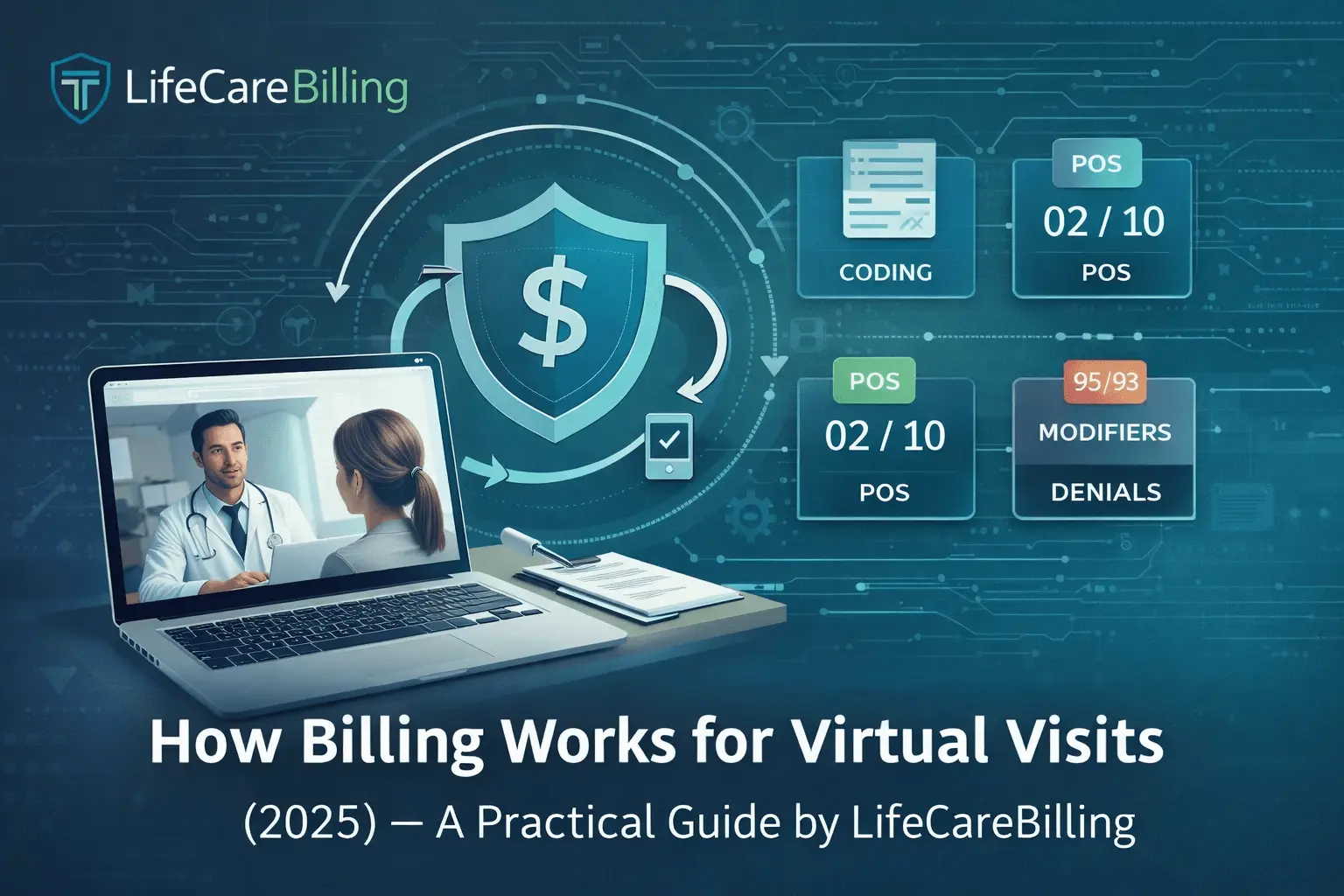

HIPAA is ultimately about protecting PHI—especially electronic PHI (ePHI). In telehealth, ePHI isn’t only your EHR note. It can include your appointment data, visit links, portal messages, audio/video encounter details, files, screenshots, intake forms, billing attachments, and more.

That’s why HIPAA compliant telehealth isn’t one tool. It’s the full environment around the visit.

When practices struggle, it’s usually because they treat telehealth like a “video event” instead of a “data workflow.” But HIPAA cares about the workflow.

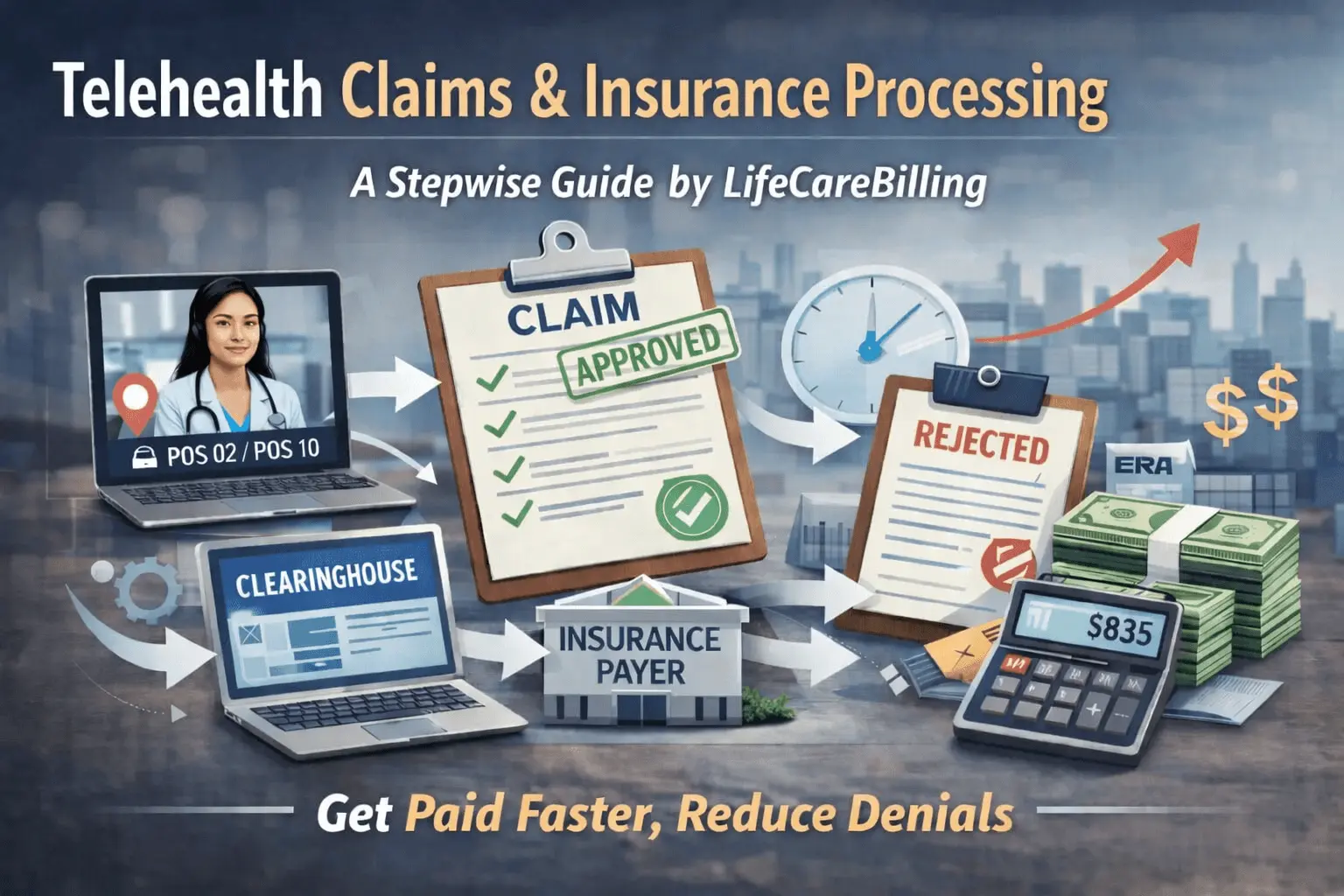

LifeCareBilling helps you control that workflow—by building structure into the operational parts that most practices leave informal: how intake is handled, how documentation stays consistent, how staff access is controlled, how billing data moves cleanly, and how issues get tracked early before they become patterns.

The big 2026 reality: you can’t rely on “pandemic-era habits” anymore

Many telehealth teams grew fast during the early pandemic, and some habits carried over: using tools that were “good enough,” relying on informal processes, and assuming flexibility would remain.

Now, if telehealth is a real service line in your practice, your compliance has to be real too.

That doesn’t mean you need to become a compliance expert overnight. It means you need a system that stays consistent—even when you’re busy.

That’s what LifeCareBilling is built to support: operations that stay stable under load.

The #1 telehealth compliance rule that practices overlook: the BAA

If there’s one issue that repeatedly creates risk, it’s vendors touching PHI without the right agreement.

If a vendor creates, receives, maintains, or transmits PHI on your behalf, you typically need a Business Associate Agreement (BAA). This matters because many practices assume a vendor is compliant simply because they say “secure,” “encrypted,” or “HIPAA-ready.” But those words are not the same thing as having the correct contractual protections in place.

A practical way to think about it is simple: if the tool touches PHI, treat it like it needs HIPAA-level handling—and often a BAA.

This is where LifeCareBilling helps in a way that feels very real. When we support telehealth teams, we help reduce chaos by bringing clarity to the workflow: what tools are being used, what touchpoints include PHI, where your operations are inconsistent, and where your “quiet risks” are hiding.

We’re not replacing legal counsel. We’re helping you build a clean operational map so your compliance and legal teams can make decisions with confidence—while your revenue cycle stays organized.

The compliance move that actually protects you: risk analysis

If you do one thing that genuinely improves telehealth security, start with risk analysis.

A risk analysis is not just paperwork. It’s a practical review of your telehealth environment: where data flows, where vulnerabilities exist, how staff access PHI, how devices are secured, what happens when remote work is involved, how files are shared, where recordings are stored (if you record), and what your incident response looks like if something goes wrong.

The reason risk analysis matters is because telehealth setups change constantly. New tools. New staff. New locations. New workflows. If you don’t revisit your risks, your environment drifts into inconsistency—and that’s when mistakes happen.

LifeCareBilling supports this in an operational way: we help you standardize the daily workflows that reduce risk automatically. When your intake process is consistent, documentation is structured, staff roles are clearly defined, and your billing flow is clean, you remove the conditions that usually create compliance breakdowns.

The truth about “HIPAA-compliant telehealth”: it’s a behavior system

Most providers expect compliance to be a technology problem. But in reality, compliance is usually a behavior problem.

Teams get busy. A staff member takes shortcuts. Someone uses a personal device without safeguards. Someone shares a login because it’s “faster.” Someone messages a patient outside the approved workflow. Someone downloads a file and stores it in the wrong place. Someone adds tracking to a page without realizing it’s part of a care pathway.

This is why LifeCareBilling focuses on structure. Not just rules—structure.

We help telehealth practices build “default-safe” workflows. That means your team doesn’t have to remember a dozen rules every day. The system leads them into the right behavior automatically.

When your system is structured, compliance becomes easier. And when compliance becomes easier, your revenue cycle becomes more predictable too—because fewer errors, fewer exceptions, fewer reworks, fewer denials.

Consent, recording, and the “small moments” that create big risk

Telehealth compliance isn’t only about encryption and logins. It also includes your operational choices.

If you record visits, you need clear policies—how consent is handled, how recordings are stored, who can access them, how long they’re retained, and how patients are informed. Recording without structure is one of the fastest ways to create risk.

Even without recording, the “small moments” matter. Identity confirmation. Patient privacy (are they in a private location for sensitive visits?). How your staff handles internal communication. Whether screenshots happen. Whether files are shared through random links.

LifeCareBilling supports teams by helping them avoid chaos. We help you build consistent intake and documentation routines so your staff isn’t guessing—and when staff aren’t guessing, they stop improvising. Improvisation is where compliance mistakes happen.

A modern risk many practices miss: tracking pixels and online analytics

This is a big one, especially for telehealth businesses and growing clinics.

Many practices run marketing pixels and analytics tools to track conversions and performance. That’s normal for business growth. The risk starts when tracking tools appear on pages that are part of patient care workflows—appointment booking, intake, portal logins, symptom flows, or any page that can include identifiable health-related information.

This is why telehealth compliance today includes your website setup—not just your video platform.

LifeCareBilling helps by thinking like an operator. We help you separate “marketing pages” from “care pathway pages” and build safer boundaries. When your growth strategy is intentional, you can still market effectively—without creating privacy exposure inside your patient journey.

Multi-state telehealth: compliance grows as your footprint grows

If you’re operating across state lines, HIPAA is only one layer. Telehealth often intersects with state-level privacy rules, licensure rules, and specialty-specific requirements. That’s why multi-state telehealth teams need more structure—not more stress.

And this is where LifeCareBilling becomes especially valuable.

Because multi-state scaling creates revenue pressure too. Credentialing and enrollment delays. Documentation inconsistency across providers. Differences in workflows across locations. A/R gaps. Denial patterns that repeat because the root cause isn’t being tracked.

LifeCareBilling supports telehealth growth by keeping your operational core stable: consistent documentation habits, organized enrollment workflows, structured revenue cycle routines, and reporting visibility that shows you where problems are forming—before they become expensive.

The real reason this matters: compliance and revenue are connected

A lot of practices separate “compliance” and “billing” like they’re two unrelated departments.

In telehealth, they’re connected.

When compliance workflows are messy, documentation becomes inconsistent. When documentation is inconsistent, claims become risky. When claims become risky, denials go up. When denials go up, A/R grows. When A/R grows, cash flow becomes unpredictable—especially when your volume increases.

LifeCareBilling helps telehealth teams by building the bridge between compliance-friendly operations and revenue stability. We help you create workflows that are easier to defend, easier to submit, easier to follow up, and easier to scale.

We’re not here to overload you with policies. We’re here to make your telehealth operation run like a system.

How LifeCareBilling helps telehealth teams stay compliant—and attractively scalable

If you want telehealth growth without stress, you don’t need more complicated tools. You need fewer weak points.

LifeCareBilling helps you reduce weak points by building operational clarity across the workflows that create the most risk and the most revenue leakage: intake, documentation, staff access routines, vendor/process consistency, claim submission discipline, denial prevention, and A/R follow-up.

We support telehealth teams in New York (including Long Island) and nationwide. And we focus on what matters most to providers: predictable payments, fewer denials, cleaner workflows, and systems that your staff can actually follow when the schedule is full.

If you’re scaling telehealth and you want a clean next step, start here:

Call (631) 966-1755 or click Get Free Billing Analysis to see exactly what’s working, what’s risky, what’s leaking revenue, and how to build a telehealth workflow that stays secure, compliant, and scalable with LifeCareBilling.

Back to Blog

Back to Blog January 6, 2026

January 6, 2026